Investment Opportunities in South Korea

This article delves into the dynamic realm of investment opportunities in South Korea, a market burgeoning with potential for tech startups and small to medium-sized enterprises (SMEs) poised to make their mark on the global stage.

We will also examine the vibrant tech landscape and the cultural nuances vital for businesses looking to establish a foothold in this innovative environment.

South Korea represents a fusion of ancient heritage and cutting-edge innovation, a juxtaposition that offers a unique landscape for investors and entrepreneurs. North American and European entities aiming to navigate this intricate market should understand the subtleties of South Korean business etiquette, and consumer behavior is crucial.

These insights pave the way for not just entering the market but also for thriving within it, bridging the gap between diverse corporate cultures and consumer bases that are highly educated yet diverse in their linguistic backgrounds. To explore options for bolstering your business’s prospects in South Korea, we invite you to initiate a conversation with us through our contact page.

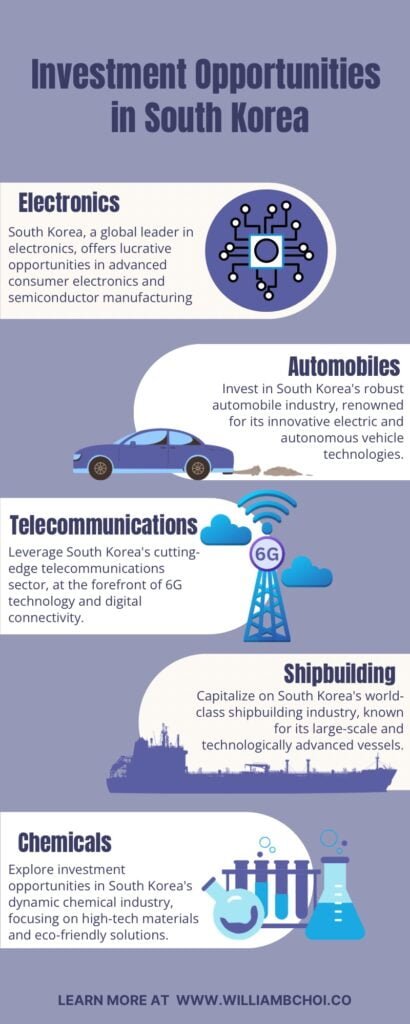

Key Investment Sectors in South Korea

In South Korea, several sectors stand out for their innovation and growth potential.

Electronics

South Korea’s commitment to the electronics industry is robust, with a planned investment of 614 trillion won ($483 billion) earmarked for developing industrial complexes over the next 20 years. These investments will target cutting-edge sectors like semiconductors, electric vehicle batteries, and display panels.

This strategy is further reinforced by significant contributions from industry leaders such as Samsung Electronics, which invested 300 trillion won to build a chip cluster alone. The government’s support extends to academic institutions, ensuring a steady stream of skilled talent.

This ambitious blueprint underscores South Korea’s role as a pivotal player in the global electronics and semiconductor market, promising a fertile ground for investment.

Automobiles

South Korea’s automobile industry is at the cusp of transformation, with a staggering investment exceeding 95 trillion won directed towards it over five years. The strategic intent is to manufacture 3.3 million electric vehicles by 2030 to secure a 12% slice of the global market share.

The government’s aggressive push is designed to enhance the country’s competitive edge amidst protective trade measures like the US Inflation Reduction Act. With Hyundai Motor already a significant player, the objective is to elevate South Korean brands to the top ranks globally.

These moves signal a lucrative avenue for investors, with the industry progressing toward innovation and dominance.

Telecommunications

The South Korean telecommunications market is pioneering AI integration, MVNO expansion, and 6G technology development. The sector, characterized by aggressive AI investments from leading companies, aims to offer consumers greater service diversity and competitive pricing.

South Korea is a trailblazer, not settling with 5G—already adopted by 40% of mobile subscribers—but pushing forward with the K-Network 2030 strategy for 6G.

This forward-looking approach, coupled with supportive government policies, renders the telecommunications sector a prime candidate for investment, promising to be at the forefront of global telecommunications innovation.

Shipbuilding

The shipbuilding sector in South Korea has been earmarked for dominance, with the government setting ambitious goals for a 75% market share in eco-friendly vessels and a 55% share in autonomous ships by 2030.

The country is leveraging its current global leadership position, technological expertise, and increased productivity through digital advancements to establish an unassailable lead.

Investments in the training and development of smart shipyards indicate a future of sophisticated and sustainable shipbuilding, making it a prime target for investment focusing on eco-efficiency and technological supremacy.

Chemicals

South Korea’s chemicals sector, the world’s 5th largest in production scale, is evolving rapidly. The high demand for sophisticated chemical products, particularly in leading exports like semiconductors and electronics, presents significant investment opportunities.

The sector’s growth is fueled by domestic demand and exports, with a strong focus on innovation. The government supports the industry by importing raw materials for processing and re-exporting, ensuring a vibrant chemical production ecosystem.

The sector’s inclination towards high-value, fine chemical technology and the rise in demand for innovative materials position it as an attractive investment sector with a high potential for growth and profitability.

Economic Overview of South Korea

South Korea, ranked 12th globally and 4th in Asia in economic power as of 2023, exemplifies a remarkable economic transformation, evolving from poverty to high-income status within a generation.

Despite the impacts of global financial turmoil, trade disputes, and the COVID-19 pandemic, South Korea has shown resilience, with public finances remaining stable due to stimulus packages and policy measures.

The country’s GDP growth is projected to be 2% in 2023. Industrial innovation frameworks have been implemented, focusing on data, networks, AI, and emerging industries like biohealth and future cars.

Challenges remain, including a trade deficit influenced by global demand fluctuations and rising oil prices, deepening social inequalities, and the need for employment reforms.

Inflationary pressures persist, influenced by global events, requiring South Korea to navigate a complex international economic landscape.

Business Environment and Friendliness

South Korea offers a robust business environment, ranking highly on the global stage for ease of doing business. Its strong economy is underscored by leadership in high-tech sectors such as semiconductors, automobiles, and shipbuilding.

Business culture emphasizes punctuality, respect for hierarchy, and a balance between formality and friendliness.

The country’s economic policies, especially under the current administration, are geared towards deregulation and stimulating growth, which can favor foreign businesses looking to invest.

Moreover, South Korea’s strategic geographic positioning between China and Japan provides additional economic leverage within the vital Northeast Asian market.

Legal Considerations

Foreign investors looking at South Korea should note that the country is open to investment, except for defense or special tech areas tagged as “National Core Technology.”

Here, things get strict with extra checks to prevent important tech from slipping out of the country. Usually, getting the okay for your investment can be quick, but if it’s in a sensitive area, it could take up to six months due to thorough tech reviews.

Chatting with the company you’re investing in or the South Korean Ministry of Trade, Industry, and Energy is an excellent move to ensure all is clear before diving in.

Challenges and Solutions to Investing in South Korea

Navigating the investment landscape of South Korea presents a unique set of challenges juxtaposed with promising opportunities. As a country known for its rapid economic development and technological innovation, South Korea offers fertile ground for foreign investment.

However, potential investors must consider the intricacies of its political transitions, economic policies, and social dynamics, which shape the business environment.

Below is a list of these hurdles and present strategic solutions, providing investors with the insights necessary to succeed in South Korea’s vibrant but complex market.

Political Transition and Policy Continuity

The transition of administrations can lead to uncertainties in policy continuity. The conclusion of the Moon administration left some initiatives, such as the 100 Policy Tasks and New Deal, partially unfulfilled, awaiting the direction of the succeeding administration.

Solution: Investors should stay informed about the new administration’s political climate and policy directions. Building relationships with local experts and political analysts can provide insights into potential policy shifts.

Political Reforms and Democratic Quality

There is a recognized need for political reforms to enhance the quality of democracy, including decentralizing power and reforming the electoral system.

Solution: Engaging in dialogue with policymakers and participating in industry associations can give investors a voice advocating for reforms that improve the business environment.

Economic Transition

South Korea faces the challenge of transitioning to a fourth-industrial economy amidst declining productivity and export competitiveness.

Solution: Embrace and invest in the sectors driving the fourth industrial economy, such as AI, biotech, and digital services. Also, leverage government initiatives like the Green and Digital New Deals.

Social Challenges and Labor Market

Addressing social issues like non-regular employment, youth unemployment, and housing affordability is crucial for economic vitality.

Solution: Investing in socially responsible projects and companies that promote fair employment practices can contribute to societal well-being and foster a more stable investment climate.

International Relations and Trade

South Korea must balance its relationships with the US and China, which can be challenging given their differing economic and political interests.

Solution: Diversify investments and partnerships to mitigate risks associated with geopolitical tensions. Consider engaging with South Korea’s efforts to expand its diplomatic and trade networks beyond traditional powers.

Market Entry and Business Practices

Foreign businesses face unique industry standards, opaque regulations, resistance to foreign business models, and intense competition from domestic manufacturers.

Solution: Companies should be innovative and patient when entering the Korean market. Understanding local business practices and remaining flexible in negotiations can lead to successful market entry and operations.

Tariff and Trade Agreements

Navigating free trade agreements and understanding tariff reductions can be complex.

Solution: Utilize trade agreements like the KORUS FTA to benefit from reduced tariffs and stay abreast of changes in trade policies to maintain competitiveness.

Contractual and Business Relationships

The Korean business culture views signing a contract as the beginning rather than the end of a business relationship, which differs from Western practices.

Solution: Develop a deep understanding of Korean business etiquette and be prepared to renegotiate terms while maintaining a long-term partnership.

Cultural Insights For Business

Here’s a list of a few cultural insights that are the bedrock of building a successful business relationship in South Korea:

- National Pride: South Koreans have a strong sense of unity and national pride, which can influence business interactions.

- Confucian Values: Respect for hierarchy and age is crucial in business dealings, reflecting the country’s Confucian principles.

- Saving Face: Reputation and social standing are significant, so always aim to show respect and avoid causing embarrassment.

- Personal Hierarchy: Be prepared for personal questions, as Koreans often determine your social and business hierarchy during initial meetings.

- Language Matters: Using some Korean phrases shows effort and respect, which is well-received and can smooth business discussions.

- Modern Yet Traditional: Despite rapid modernization, traditional customs still play a part in business, so adaptability to both is critical.

- Ethical Business: Transparency and ethical practices are expected, with South Korea having a moderately clean corruption perception.

Conclusion

South Korea is a beacon of innovation and resilience, a dynamic hub where tradition and modernity converge, offering diverse investment opportunities.

Each sector reflects the country’s steadfast commitment to growth and technological advancement, from the fast-evolving electronics sector to the robust automobile and shipbuilding industries.

Navigating this landscape requires an appreciation of South Korea’s unique business etiquette and cultural nuances, underpinned by a solid national ethos.

For investors equipped with patience, respect for hierarchical relationships, and a willingness to engage with the local context, South Korea presents a horizon rich with potential and ripe for success.